President Joe Biden said in his May 28 Time interview that China’s “got an economy that’s on the brink.”

He’s right.

And we should care because Xi Jinping may try to solve his economic problems by starting another war.

At first glance, Biden’s gloomy assessment looks wrong. The official National Bureau of Statistics reported that China’s gross domestic product beat expectations by a wide margin, growing 5 percent in the first calendar quarter of this year compared to the same period last year. That’s a slight improvement of the robust 5 percent growth for all of last year.

But neither of these reports makes sense. As Anne Stevenson-Yang of J Capital Research told me this week, “I feel the numbers just don’t mean anything anymore.”

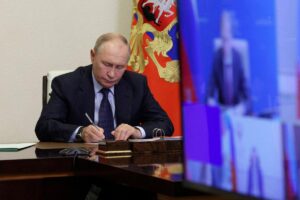

Xi Jinping boards the aircraft carrier Shandong and reviews the guard of honor at a naval port in Sanya, Hainan Province, on December 17, 2019. On April 24, U.S. Indo-Pacific Command chief John Aquilino warned China intends to be capable of invading Taiwan by 2027. Less LI GANG/XINHUA VIA GETTY IMAGES

There is now a large gap between reported results and what we can observe. The widely followed Rhodium Group believes the economy grew about 1.5 percent last year. That’s in the ballpark of the “now close to 2 percent a year” that Biden reportedly told a group of Democratic Party donors in Park City, Utah last August.

Growth has almost certainly declined since then. “China’s economy is in a slow grind downwards,” Andrew Collier of Hong Kong-based Orient Capital Research told me.

“Start-ups are closing, no one can find a job, millions of people are paying mortgages on apartments that haven’t been built, city services are closing down—it’s a grim situation for Chinese people,” says Stevenson-Yang, also author of Wild Ride: A Short History of the Opening and Closing of the Chinese Economy. “The sad thing about China is that the economic model has reached the end of its useful life, and there is nothing to do but change the model or incur great suffering.”

“It must be really scary when the economic model simply stops working,” she added. “Ours had a heart-stopping moment in 2008, but we knew that if we got over the bad patch, capitalism basically worked.”

China is now having its long-delayed 2008 crisis.

In 2008, Chinese leaders Hu Jintao and Wen Jiabao decided they would not suffer a downturn, so they embarked on the biggest debt-fueled stimulus program in history. China went on a building binge and created double-digit growth. As a result, the country is now grossly overbuilt. For instance, China, according to a former deputy head of the statistics bureau, has enough vacant apartments to house more than 1.4 billion people, the entire population of the country. Some believe there are enough empty apartments for three billion.

Infrastructure, especially the Chinese rail system, was also overbuilt. Groaning under about $900 billion of debt, China State Railway Group has begun to cut back service by closing at least 26 high-speed rail stations.

Now Hu’s and Wen’s successors have to figure out a way to pay back rail and all other debt. Even if the Chinese economy were growing as fast as currently reported, they would still have no way to do so.

China’s total-country debt-to-GDP ratio in reality is probably around 350 percent, if not higher. No one knows because there is so much “hidden debt,” and Beijing has been issuing inflated GDP statistics.

One thing we do know: A debt crisis is coming, and it could be history’s biggest.

Almost all observers recommend that China move to a consumption-based economy before it’s too late, but Xi Jinping will not do that. Nobel laureate Paul Krugman told Bloomberg Television recently that China “seems bizarrely unable” to adopt “even modest steps towards a refocusing on domestic demand.”

Xi will not stimulate domestic demand or encourage consumption. Consumption, after all, would empower ordinary Chinese people, something that would weaken Communist Party control of the economy. It would also erode the power of state enterprises, a core Party constituency, and even undermine the financial stability of the gargantuan but precarious state banks.

Xi has only one solution: pour money into factories and hope to export his way out of the predicament. This plan, however, assumes that other countries will continue to accept Chinese goods. “Never mind the theories about free trade, this is just not going to happen,” said Krugman. “We can’t absorb. The world will not accept everything that China wants to export.”

Already, countries are starting to resist. On May 14, Biden announced increases in tariff rates on China’s steel and aluminum, semiconductors, electric vehicles, batteries and battery components and critical minerals, solar cells, ship-to-shore cranes, and medical products. The tariffs were “to protect American workers and businesses from China’s unfair trade practices,” per the administration.

Biden’s tariff moves will accelerate a trend. America’s merchandise imports from China plunged a stunning 20 percent last year. China is now no longer the largest source of imports for America. U.S. exports to China also declined by 4 percent. Overall, U.S.-China two-way trade fell 16 percent last year. This year, two-way trade for the first four months dropped 3 percent.

The European Union may follow suit in imposing higher tariffs, and even Beijing’s friends in the “Global South” are showing reluctance to accept Chinese goods.

So far this year, China’s exports have been unimpressive—up 2 percent in the first five months, compared to the same period last year—which means Xi Jinping’s plan is not succeeding. Collier does not think China’s economy will “collapse”—”there are too many moving parts”—but the “structural decline,” he says, “will last years.”

“I am hopeful that this may lead to a moderation of China’s ‘wolf warrior’ diplomacy and an improvement in global relations given the importance of trade and the U.S. dollar to the economy,” Collier said.

A moderation of Chinese policy is still in the cards, but China’s aggressive leader could decide to take a more belligerent approach. Last August, Biden called China a “ticking time bomb.” The trigger for a detonation could be Xi Jinping’s realization that the Chinese economy cannot be rescued, which means he would see a closing window of opportunity to achieve his expansive ambitions.

And he may perceive a closing window as a way to stay in power. If you’re Xi Jinping facing a failing economy, do you accept forced retirement and possible incarceration or do you invade some neighbor?

Already there are signs of discontent in the Chinese leadership and military. A war, Xi might reason, would likely prevent his political enemies from removing him from power.

Source: Newsweek